vehicle personal property tax richmond va

Personal property taxes on automobiles trucks motorcycles low speed vehicles and motor homes are prorated monthly. Is more than 50 of the vehicles annual mileage used as a business expense for federal income tax purposes OR reimbursed by an employer.

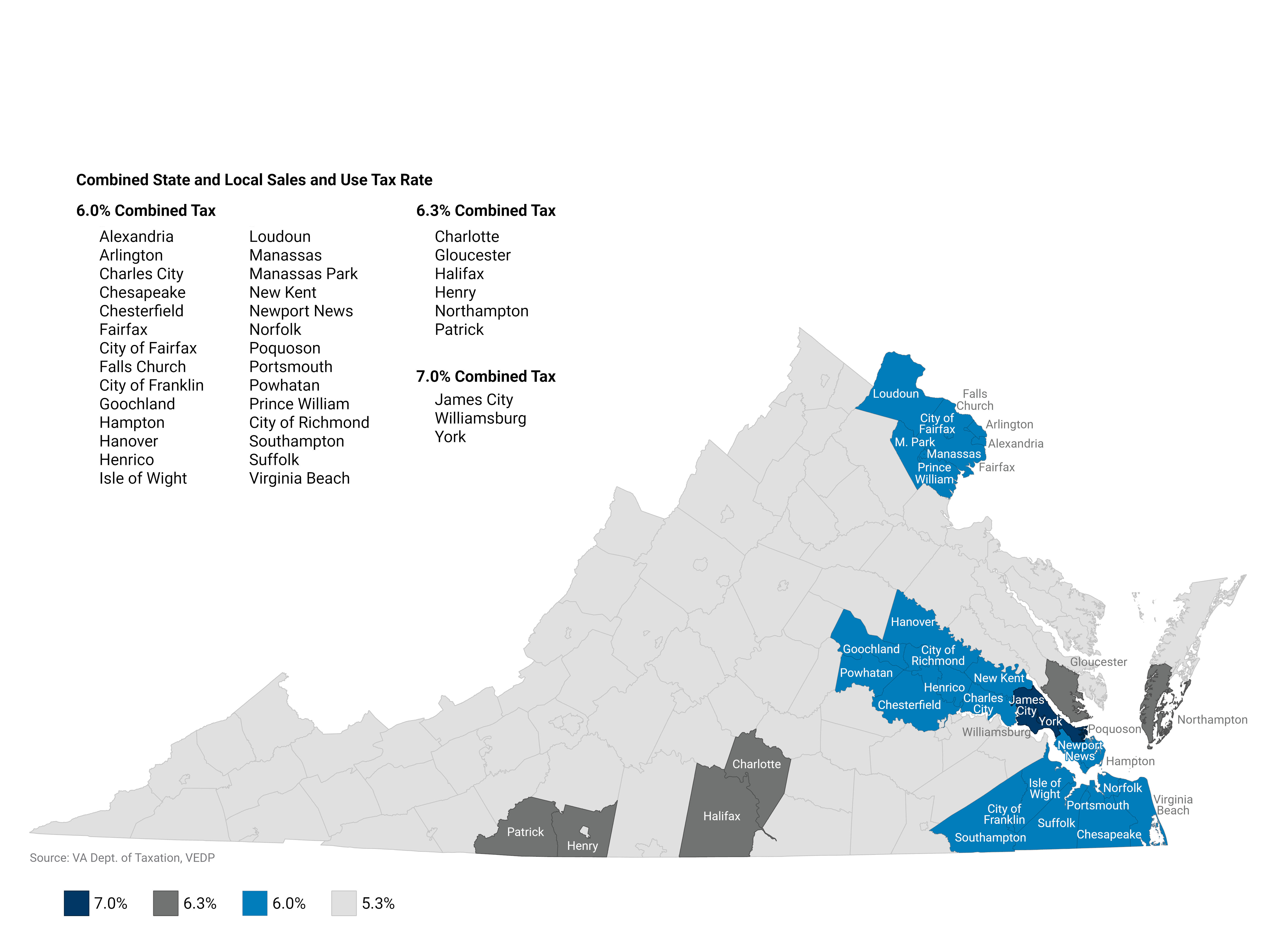

Commercial And Industrial Sales Use Tax Exemption Virginia Economic Development Partnership

Interest is assessed as of January 1 st at a rate of 10 per year.

. Ad The Leading Online Publisher of National and State-specific Leases Legal Documents. Ad Get Assessment Information From 2022 About Any County Property. At the calculated PPTRA rate of 30 you would be required to pay.

Use our website send an email or call us weekdays from 8AM to 430PM. If your vehicle is valued at 18030 the total tax would be 667. Personal Property Taxes Personal Property taxes are billed annually with a due date of December 5 th.

On Tuesday the council voted. Personal Property Taxes are billed once a. Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

Monday - Friday 8am - 5pm Mayor Levar Stoney. The 10 late payment penalty is applied December 6 th. For questions regarding mobile homes please contact the Commissioner of the Revenue by phone at 804-748-1281 or via email at.

The personal property tax rate is determined annually by the City Council and recorded in. Monday - Friday 8am - 5pm Mayor Levar Stoney. Admissions Lodging and Meals Taxes Online Payment Parking Violations Online Payment Real Estate and Personal Property Taxes Online Payment 900 E.

If you can answer YES to any of the following questions your vehicle is considered by state law to have a business use and does NOT qualify for personal property tax relief. Titling and registering a vehicle with the Virginia Department of Motor Vehicles DMV does not automatically register the vehicle with the City of Alexandria. The Personal Property Tax rate is 533 per 100 533 of the assessed value of the vehicle 355 for vehicles with specially-designed equipment for disabled persons.

WWBT - As Richmond residents see an increase in their personal property tax bills Richmond City Council has extended the due date for the payments. Broad Street Richmond VA 23219 Hours. Please contact the Commissioner of Revenue at 804-333-3722 if you have a question about your assessment.

Broad Street Richmond VA 23219 Hours. An example provided by the City of Richmond goes like this. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as of January 1 st of each tax year.

Boats trailers and airplanes are not prorated. If you can answer YES to any of the following questions your vehicle is considered by state law to have a business use and does NOT qualify for personal property tax relief. The personal property tax is calculated by multiplying the assessed value by the tax rate.

703-222-8234 TTY 711. Young Tarry Division Director. We are open for walk-in traffic weekdays 8AM to 430PM.

1Applying an 88 assessment ratio so that vehicle personal property tax bills will be based on 88 of a vehicles value in CY 2022 offsetting much of the increase that taxpayers would have experienced if. If you have questions about your personal property bill or would like to discuss the value assigned to your vehicle please contact the Department of Finance by phone at 804 501-4263 email at taxhelphenricous or fax at 804 501-5288. For Arlington County residents.

Searching Up-To-Date Property Records By County Just Got Easier. All cities and counties in Virginia have a personal property tax which helps fund local government. The current rate is 350 per 100 of assessed value.

Answer the following questions to determine if your vehicle qualifies for personal property tax relief. All property is taxable based on ownership. Is more than 50 of the vehicles annual mileage used as a business.

Hampton Inn Suites Richmond Virginia Center In Glen Allen Va Expedia

Virginia Commonwealth Veteran Benefits Military Com

/cloudfront-us-east-1.images.arcpublishing.com/gray/NTPQSKFDUNEOZC7K3FEN5XGAXQ.jpg)

Personal Property Taxes Up By Average Of 25 In Charlottesville

Pay Online Chesterfield County Va

/cloudfront-us-east-1.images.arcpublishing.com/gray/NTPQSKFDUNEOZC7K3FEN5XGAXQ.jpg)

Personal Property Taxes Up By Average Of 25 In Charlottesville

New Tax Assessments Show Richmond Property Values Surging 7 3 Percent The Biggest Increase In A Decade Richmond Local News Richmond Com

345 Clovelly Rd Richmond Va 23221 Realtor Com

Washington Property Tax Calculator Smartasset

New Tax Assessments Show Richmond Property Values Surging 7 3 Percent The Biggest Increase In A Decade Richmond Local News Richmond Com

New York Property Tax Calculator Smartasset

New Tax Assessments Show Richmond Property Values Surging 7 3 Percent The Biggest Increase In A Decade Richmond Local News Richmond Com

Personal Property Taxes Up By Average Of 25 In Charlottesville

Pay Online Chesterfield County Va

2313 Rosewood Ave Richmond Va 23220 Zillow

Used Honda Fit For Sale In Richmond Va Edmunds

Virginia S Individual Income Tax Filing Extension Deadline For 2020 Taxes Is Nov 17 2021 Virginia Tax